FHA mortgage changes are coming September 15, 2015. It’s very important that you familiarize yourself with these changes and know how they might affect you if you are in the market for an FHA home loan.

FHA mortgage changes are coming September 15, 2015. It’s very important that you familiarize yourself with these changes and know how they might affect you if you are in the market for an FHA home loan.

Here is the list of changes:

Credit

- Hud now lists acceptable credit history to manually approve files now (4000.1 II A 5 a iii) with maximum number of lates

- Charge-offs must be addressed and explained

- Timeshare foreclosure is not a foreclosure –its considered installment

- Defined derogatory event date to the assigment of the FHA Case number

Gifts

- Donor bank statements are now required on all gift transactions along with copy of check

- Government/non-profit entities must provide a gift letter

Manual downgrade required for:

- Business income decline of 20% or more and income must be documented as stable

- Only the non-occupying co-borrower(s) have credit score(s)

- Undisclosed mortgage debt not on credit report

Mixed Use

- Minimum 51% of the entire building square footage must be residential

Debt

- Omitted debt must be less than 10 payments and all cumulative omitted payments must be less than 5% of borrowers gross monthly income in order to exclude from qualifying ratios

- Borrower may not pay down to 10 months in order to exclude debt

- If the borrower has child support/alimony payments, 28 days of consecutive paystubs must be obtained in order to verify no garnishments

- Deferred student loans must utilize an actual payment(if payment is zero or deferred – then must utilize 2% of the balance in the debt ratio) (4000.1 II A 5 f iv)

- Authorized user accounts must be included in debt ratio unless it is documented that the primary obligor has been making the payments for the previous 12 months

- 30 Day accounts: verify borrower has funds to pay off balance on credit report and if there are any lates on the account in prior 12 months, 5% of the balance must be utilized in the DTI

Rate and Term LTV

- A max LTV of 85% if borrower has not occupied as primary for last 12 months

Employment/Income

- If a borrower has changed jobs 3 or more times in the last 12 months additional guides apply

- Two years part-time employment required

- Nontaxable income can only be grossed up 15% unless the borrowers tax bracket is documented as higher

- Rental income used to qualify not filed on a return requires verification the rented property has at least 25% equity

- Rental income from vacating property can only be used if borrower is relocating more than 100 miles from the property

- Voluntary child support allowed with proof of payment and cancelled checks

Miscellaneous

- Earnest money must be verified if 1% or greater of the sale price

- Military on active duty are now eligible if you document they will occupy when discharged and are based over 100 miles away

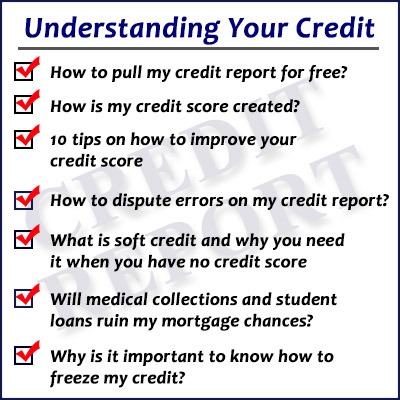

Why Is It Important To Know How To Freeze My Credit?

Why Is It Important To Know How To Freeze My Credit?

Leave a Reply