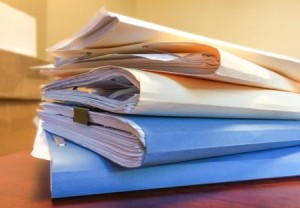

Today I received an email from the CEO of our company with an article attached entitled, “500-page mortgage applications are the new normal.”

As I read through the article I couldn’t help but laugh when I came to the line, “Once easy to carry in one hand, the average mortgage application file has now ballooned to 500 pages…” Once my laughter stopped I paused for a moment and realized, this isn’t an over-exaggeration.

As I read through the article I couldn’t help but laugh when I came to the line, “Once easy to carry in one hand, the average mortgage application file has now ballooned to 500 pages…” Once my laughter stopped I paused for a moment and realized, this isn’t an over-exaggeration.

This is how it really is today!

How much paperwork does your loan officer really need? Well, thanks to the Dodd-Frank Act and all the new stricter guidelines put in place it seems that we are now asking for everything under the sun in order to get our clients a home loan. We even joke around here and say we even need a blood and urine sample, along with your first born. 🙂

All joking aside, this is now the new norm. If you are looking to purchase or refinance your home you need to be prepared for what your loan officer will be asking you for in order to get you a home loan. We try to prepare all of our clients for the shock of what we will be asking them for through the process, but it never seems to fail, they are still baffled when we ask them for more.

So the moral of this story is…

If you are in the market for a new home loan be prepared to provide everything your loan officer asks for in a timely manner. We know it is a pain, but if you want to get your loan done and done on time we need your cooperation and understanding.

We hate asking for all this too, but it is the world we live in now and we are required to collect all this documentation. Gone are the days of the good ole hand-shake to get a loan!

Just remember this when you are going through the loan process the next time…

We are in this together and we want your loan to close just as bad as you do, so let’s work together to get it done, rain or shine. I guarantee this will make for a much more pleasant loan transaction. And, a lot less stress on both ends.

Merry Christmas and Happy New Year!

Merry Christmas and Happy New Year!

Leave a Reply