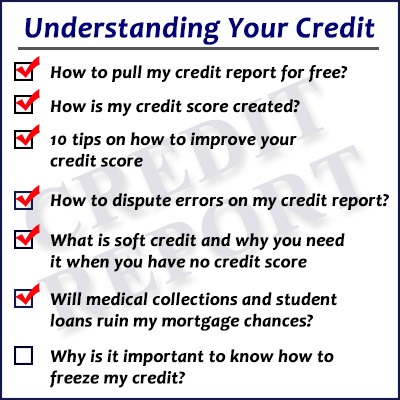

Have you ever been asked for soft credit? In today’s post we are going to answer the question, what is soft credit and why you need it when you have no credit score.

Have you ever been asked for soft credit? In today’s post we are going to answer the question, what is soft credit and why you need it when you have no credit score.

We usually come across some individuals in the office that end up having everything in order but either don’t have a credit score or don’t have enough “trade lines” open. So when we go to pull their credit report they do not have a credit score or little to no trade lines. In our line of work these people are considered a “ghost”. Most companies like to see at least three accounts open for 12 months or more in order to make sure there is some stability in your ability to manage debt.

With a lot of people not wanting to have credit cards or loans of any kind so they stay out of debt; some banks could possibly turn these individuals away for not having those “trade lines” open. Fortunately for us we have the ability to look for forms of “soft” credit and count those as some trade lines.

So what is “soft credit”? Soft credit is your bills that you pay monthly that do not show up on your credit report that can be used to show how well you manage debt. With a clean 12 month history of paying your bills we can use that in place of having a credit score or reported credit trade lines.

Here are some forms of soft credit that we have used in the past in order to help clients obtain financing for the houses they are looking at.

Forms of Soft Credit

- TV provider (cable or satellite)

- Phone bill

- Internet bill

- Car insurance bill

- Utility bill

- Trash bill

- Netflix bill

- Any bill you receive on a monthly basis…

One thing to keep in mind is that these forms of soft credit need to have a perfect 12 month history in order to use them. So if you accidentally paid your phone bill a week late and on your next bill it says there was a past due amount, you’ll have to wait until that disappears from your 12 month history before you can use it again. Hopefully with your knowledge of this you can continue to keep your dreams alive of owning your own home! Keep a lookout for our next post about medical collections and student loans!

How To Dispute Errors On My Credit Report

How To Dispute Errors On My Credit Report

Leave a Reply