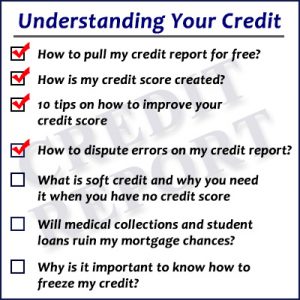

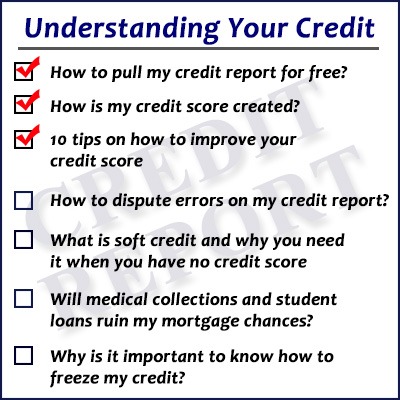

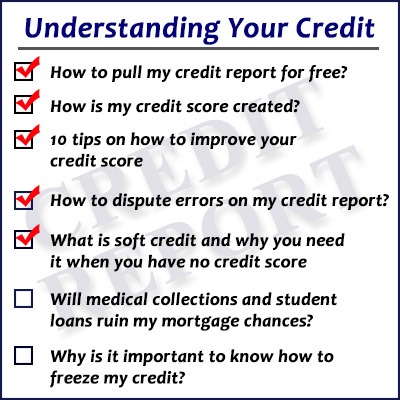

In this blog post I will be answering the question, “How to dispute errors on my credit report?” I will be showing you how I would dispute errors so you can follow along if you need to process a dispute. We’ll break it into three sections with each credit bureau and how they handle each dispute.

In this blog post I will be answering the question, “How to dispute errors on my credit report?” I will be showing you how I would dispute errors so you can follow along if you need to process a dispute. We’ll break it into three sections with each credit bureau and how they handle each dispute.

TransUnion

TransUnion actually has a lot of useful information about filing disputes and the process. TransUnion states that when they receive your dispute request they contact the data provider about the inaccuracy. After that the source has 30-45 days to investigate whether the information reported is correct. If the company doesn’t respond within that time frame, TransUnion will remove the information from your credit report. If the company does provide information stating the dispute is correct then it will remain on your credit report. To file a dispute you need to go to TransUnion’s Online Dispute page and create an account where they will verify your information. Once there you can submit any information to them about the dispute and they will take it from there.

Experian

Now for Experian’s dispute process they bring you right to a screen where it asks for a previous credit report number if you’ve already had a credit report pulled with them. Once you submit that information for them it actually brings up your credit report and has an option on the right side of every piece of information that says “Dispute”. If you need to dispute that item then click the button and it will ask you why you are disputing it and also an option to upload any documentation that may help the investigation process.

Equifax

Equifax’s dispute process was the least user friendly out of all three credit reporting bureaus. You will once again have to create a profile by submitting your personal information and then answering some security questions that only you should know. Finally it brings you to a page where it’s categorized which section you need to dispute. I actually had an incorrect address on my report so I went to the personal information webpage and clicked on dispute and selected “This address does not belong to me”. Then at the very end it brings up a dispute summary and you can review everything that you have disputed. After you have submitted it may take you to another page where it asks you to submit some information for them. For me they asked for a valid driver’s license, social security card or W-2 form, and a utility bill because my dispute involved an address. They say it may take up to 30 days and they will inform you via email on the status of the dispute.

Hopefully with this walkthrough you saw how I was able to dispute items on my credit report and you were able to use that information to help dispute items on your own credit report. In our next post we’ll be talking about what soft credit is and why you could potentially need it.

10 Tips On How To Improve Your Credit Score

10 Tips On How To Improve Your Credit Score

Leave a Reply