We hear this time and time again. Why do you need to pull my credit before we talk about interest rates or go over loan programs? There are a couple reasons why we need to pull your credit first.

We hear this time and time again. Why do you need to pull my credit before we talk about interest rates or go over loan programs? There are a couple reasons why we need to pull your credit first.

Home loans are not like car or personal loans

One main thing that a lot of people don’t know about is that home loan requirements are more strict than a car loan, personal loan, and applying for a credit card. We need more documents, more explanations, and follow more regulations than other loans you can get. This leads us to our next topic.

Programs have different credit requirements

Different loan programs have different credit requirements. If you tell us that your credit score is a 680 then you can probably qualify for the typical USDA, FHA, Conventional and sometime VA if you’re also a Veteran. However, if you fail to mention that you had a foreclosure or some late payments on a mortgage or car loan, we may be giving you incorrect information on programs you qualify for with those items showing up.

Accuracy For Your Information

When you are thinking about buying a home what is more than likely your number one concern? A lot of people think about the monthly house payment. Without having an accurate credit score, we are not able to get an accurate estimate for your interest rate. Without that, your house payment can differ and you may end up getting into a house payment that you are not happy with and under contract to buy the property anyways. Would you rather have an extremely accurate quote or leave it to chance that maybe something popped up on your credit report that dipped the scores down and then when we do get credit pulled and its lower, we’re stuck.

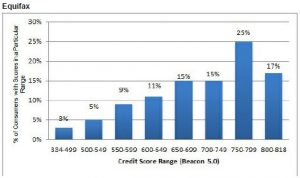

Free Credit Report Scores Are Not Accurate

Another question that we get is why are my credit scores different than what’s showing on this other companies website or on my credit card bill? The main reason that those scores can differ either positively or negatively is that the free reporting agencies are not used for true financing purposes.

Hopefully that helps you understand a little bit more about the process and why it is important for lenders to pull your credit first. If you have any questions, please contact us or if you would like to see how much home you can qualify for, please fill out our quick inquiry and someone from our team will be in touch with you shortly.

5 Tips For Buying A Home

5 Tips For Buying A Home

Leave a Reply